Top Financial Literacy & Money Management Games for Kids and Adults

Most people learn how money works by messing up first. Kids overspend their allowance, teens get their first paycheck, and then it is gone in seconds. Adults… Well, let’s not talk about adults and their “accidental” credit card bills…

The point is: managing money is not some intuitive thing, but most of us still treat it like an optional skill.

At the same time, everything around us is money-related. Just take a look at the apps nudging you to buy “just one more”, and subscriptions that silently bill your card. No surprise that more and more of us wish to learn budgeting and saving earlier.

Besides, according to OECD, more than two-thirds of 15-year-olds already use financial products and services in their daily lives. Over 60% have a bank account or a payment card, and nearly 90% have made an online purchase within the past year.

Financial products and services usage in daily live according to OECD research.

It seems like an incredibly right moment for financial literacy games and their relative’s money management games.

They let people practice real financial decisions that are actually easy to apply later. It is useful, because it doesn’t lecture you, but sort of throws you into a situation, and lets you choose. You can see the consequences later and get rewarded for acting smart. It’s the kind of practical learning most of us never got.

Obviously, design matters in these games. If you have only a spreadsheet and clipart… they won’t teach anyone anything. Unless you have game mechanics that prove they can work for adults and kids, then it changes the situation completely.

This is what the Fgfactory is doing: games for kids, education, and anyone trying to teach money skills.

Below, you’ll find the most useful financial literacy games for kids and financial games for adults, and everything in between. Besides, we’ll explore:

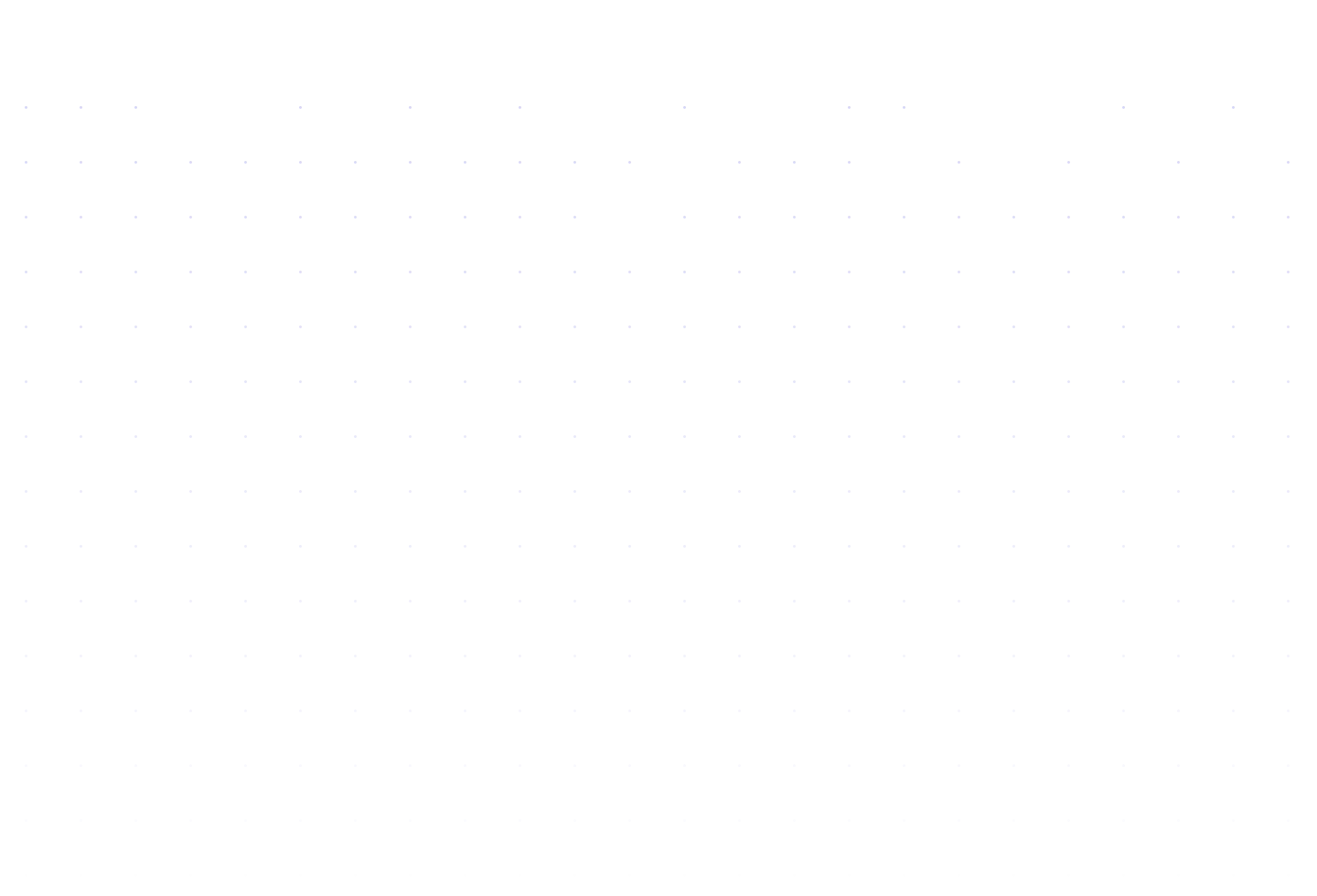

The Statistic of financial literacy by generation according to Civic Science.

- What makes financial literacy games so useful?

- What are the differences between financial games for kids and adults.

- The main benefits you get after interacting with these games.

- How games simplify complex money concepts.

- The role of EdTech and gamification in financial education.

What Is Financial Literacy

Financial literacy is not some hard, complex concept. It’s actually an incredibly simple, financial literacy definition: a knowledge and skills for handling your money wisely. But it does consist of a number of concepts you should be aware of.

- Budgeting. It is the most basic thing in financial literacy. Dividing your income, especially in a heavily marketing world as we have now, demands discipline. So, budgeting is simply planning your expenses by priority.

- Saving. The simplest way to define saving is to call it the safety net. It is also one of the pillars of financial literacy. This is what helps you to keep small setbacks actually far from affecting your life.

- Smart Spending Choices. We have already mentioned that we live in a world full of marketing. Everyone is trying to sell you something, and it often looks good. Financial literacy allows you to do the highly important things: compare options and understand value. Thanks to that, you’ll avoid buying things that create short-term happiness and which often make you regret a lot.

- Debt Management. Credit can be a nightmare, and it is for millions of people worldwide. But knowing how it works is an essential part of financial literacy. It means knowing interest rates, recognizing high-interest traps, and borrowing very smartly. In other words, borrowing only what you can really manage.

- Interest Basics. Interest has a simple nature: it can either work for you or against you. For example, on loans, it has a tendency to add up. But when it comes to savings and investments, it helps your money grow. This is a part that you can’t miss.

- Investing Fundamentals. It might seem that this is a topic for stock-market professionals. But it’s not. Knowing the basics is all you need: diversification, long-term growth, and understanding that all investments have risk. It doesn’t mean, though you have to necessarily use this knowledge.

Did you know?

A large study (28,000+ adults in the U.S.) showed that perceived financial literacy (how confident people feel) predicts good credit behavior better than just objective test scores, across ages 18+.

Improving Financial Literacy with Gamification and EdTech

To become financially educated, you need more than knowing rules and how to act in general with your money. You need practice in a safe environment. Why? Take a look at these stats:

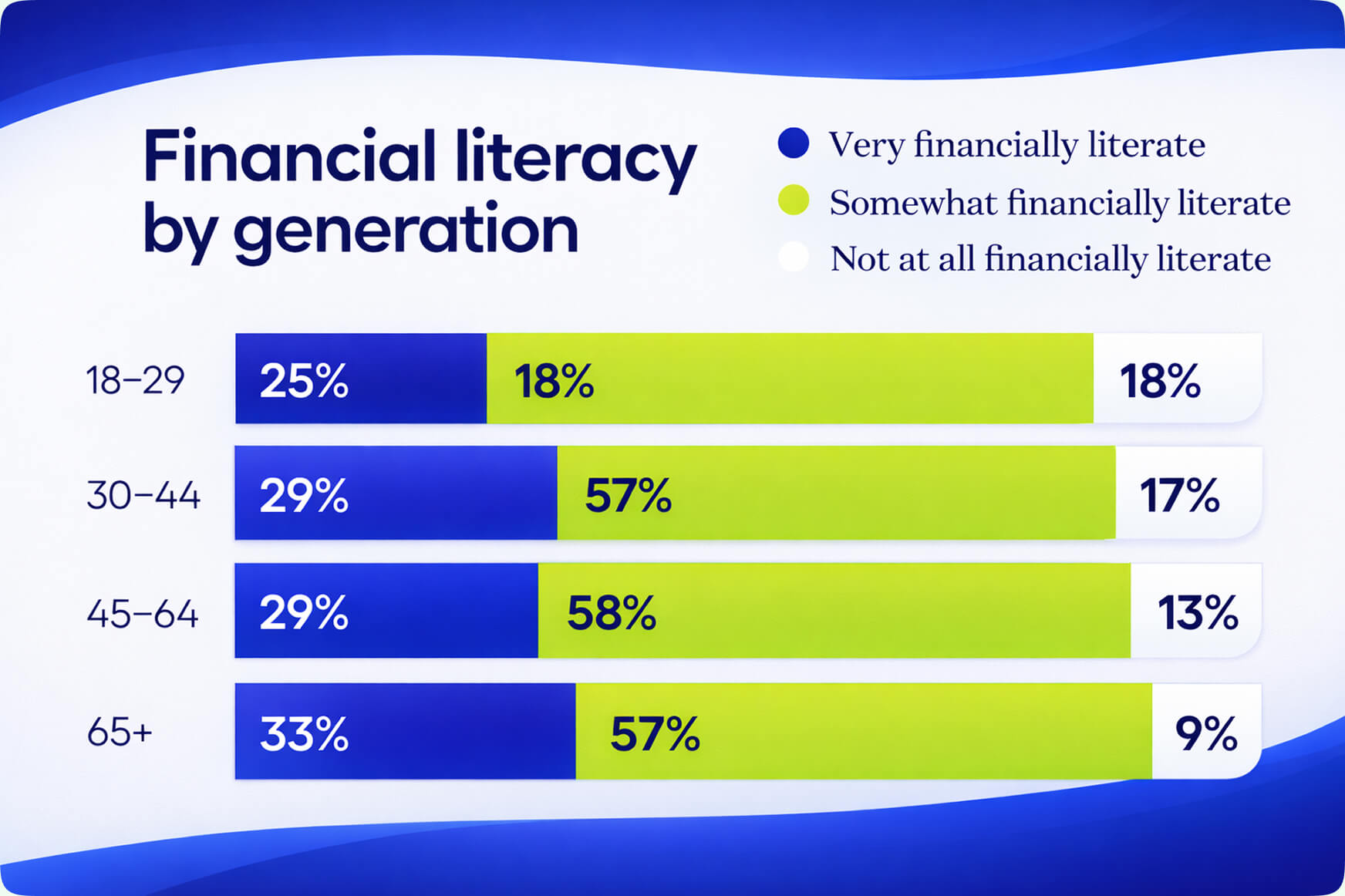

Percentage of P-Fin Index questions answered correctly across generations.

Gamification seems to be the best solution for this. It actually embodies what you are encountering in real life, but most importantly, it is safe, so you don’t have to risk your real money.

In EdTech, many companies use gamification as the core of their learning ecosystems. They provide decision trees to replicate the financial puzzle of real life. Common mechanics in games for financial literacy are the following:

- Real life financial scenarios. It is usually something we all face – like paying bills or investing.

- Quests and missions. This is, if you will, the essence of gamification. It works on rewards and progressions for making smart choices.

- Budgeting challenges. Here, most commonly, players must balance income and expenses.

- Decision options. These usually show the consequences of certain choices.

- Money management games for kids. Uses visual cues and simple rules to teach the basics.

All these mechanics exist for one reason: practice. Maybe that’s financial literacy games for kids, adults, or fun finance games designed for casual learners; the outcome is always positive. However, any of these approaches will work if the game is designed rather poorly.

And if you have only colorful characters or a scoreboard… Well that’s not going to be well. They require thoughtful pacing, age-appropriate difficulty, smooth UX, and learning goals that are an inherent part of the gameplay.

Fgfactory’s experience not only matches but confidently sets an example when it comes to all these requirements. We are building games and integrating gamification solutions that are not only fun or educational, but easily good at both these things.

Top 5 Financial Literacy Games for Kids

Teaching kids about money early is a real opportunity to build habits that will give actual benefits in adulthood. The importance of smart budgeting, saving, decision-making, and even early investing instincts is hard to underestimate. For example, starting in 2000, Georgia, Idaho, and Texas made financial education mandatory. By the third year of these programs, students’ credit scores improved. Rising by about 11 points in Georgia, 16 points in Idaho, and nearly 32 points in Texas.

Below are games and interactive tools you can explore right now.

1. Bankaroo

Bankaroo is a virtual banking app built for kids. It gives children their own “digital bank account” where they track allowance, set savings goals, and watch their money grow.

What makes it effective is the simple but real-feeling interface: kids deposit, withdraw, move money into goals, and see the consequences of spending too fast. The average user’s age, if you take a look at the site, is 5–14. In other words, those who are just starting to understand the idea of limited funds.

2. Saving Spree

This game is a winner of the Parent Choice Award. Created for 7+ years old, this game presents money choices in a fun show-style format where kids earn, save, donate, or invest virtual money while dealing with everyday financial decisions. It helps children see how choices add up and introduces them to funds for goals and emergencies.

The game shows how various lifestyle choices can create more spending or, on the contrary, affect their savings.

3. Hot Shot Business Game

What can be more exciting than trying out how it feels to be a business owner? In this game, kids can choose what local businesses they can run, and what challenges they can meet along the way. You can play the game here.

4. Zogo

Zogo is a good choice for young adults or high schoolers. Essentially, here you just learn financial literacy concepts and apply them in quizzes. The bite-sized lessons are very well-structured and fun. You can win gifts from various brands for replying to tests correctly. Which is giving the game another flavor, right?

5. Habitica

Habitica game to motivate yourself to achieve your goals.

Not a traditional money game, but a brilliant habit-builder. Habitica allows you to treat real-life tasks like they are RPG quests. And, of course, you can use it for things like saving money, tracking spending, or hitting weekly budgeting goals.

Kids create an avatar, earn rewards by completing tasks, and lose progress when they slip. This connects everyday discipline with long-term achievements, and it is all playful. Works well for older kids and teens (10+) who respond to RPG-style progression systems.

Top 5 Financial Literacy Games for Adults

If you think that because you’re an adult, you don’t need to improve your financial literacy, you might be really, really wrong. Even if you know the basics, the financial markets we exist in are changing every year, sometimes way too drastically. So adults can learn a lot of new information; plus, games are just fun.

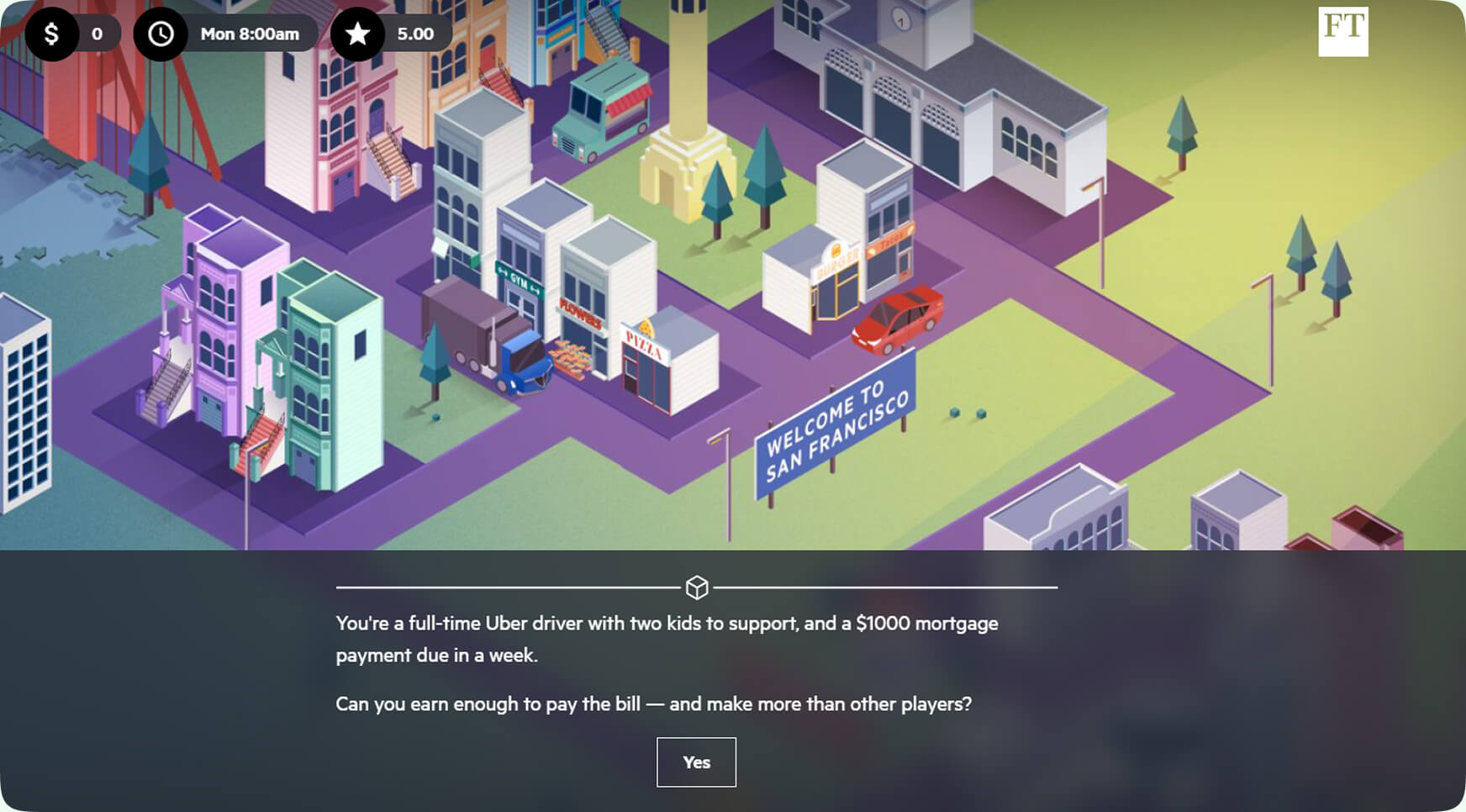

1. The Uber Game

“You’re a full-time Uber driver with two kids to support, and a $1000 mortgage payment due in a week. Can you earn enough to pay the bill — and make more than other players?” This is one of the most interactive financial literacy games. Essentially, that’s the core of this game. Exciting, isn’t it?

It is built on the number of interviews with actual Uber drivers. And you have to be an Uber driver. The main idea to explore is whether you can survive in the gig economy. The core question isn’t “Can you win?”, but “Can you survive?”

- Can you balance short-term cash needs with long-term stability?

- Can you push harder now without burning out later?

- Can you stay afloat when income is unpredictable, and life doesn’t pause?

So it not only teaches about financial literacy, but also allows you to explore a certain segment of economic reality.

2. Stock Market Game

Stock Market Game for adults and students to build an investment portfolio.

Used by schools and financial institutions across the U.S., this simulation gives adults (and students) a virtual $100,000 to build an investment portfolio. Real stock prices, real market movements, but, as is usually in gamification solutions, zero real risk. It’s one of the best ways to learn diversification, long-term investing, and portfolio balancing without touching your real savings. Ideal for adults who want to learn an investing strategy.

3. Wall Street Survivor – Investing & Financial Planning Simulator

Wall Street Survivor is a full stock market simulator combined with gamified lessons on personal finance and investing. It gives you a virtual portfolio with fake money, so you can learn how markets work without risking real cash.

It allows you to build and manage a portfolio of stocks, ETFs, and crypto with live market data. There are courses and missions that teach investing basics, risk management, and financial planning.

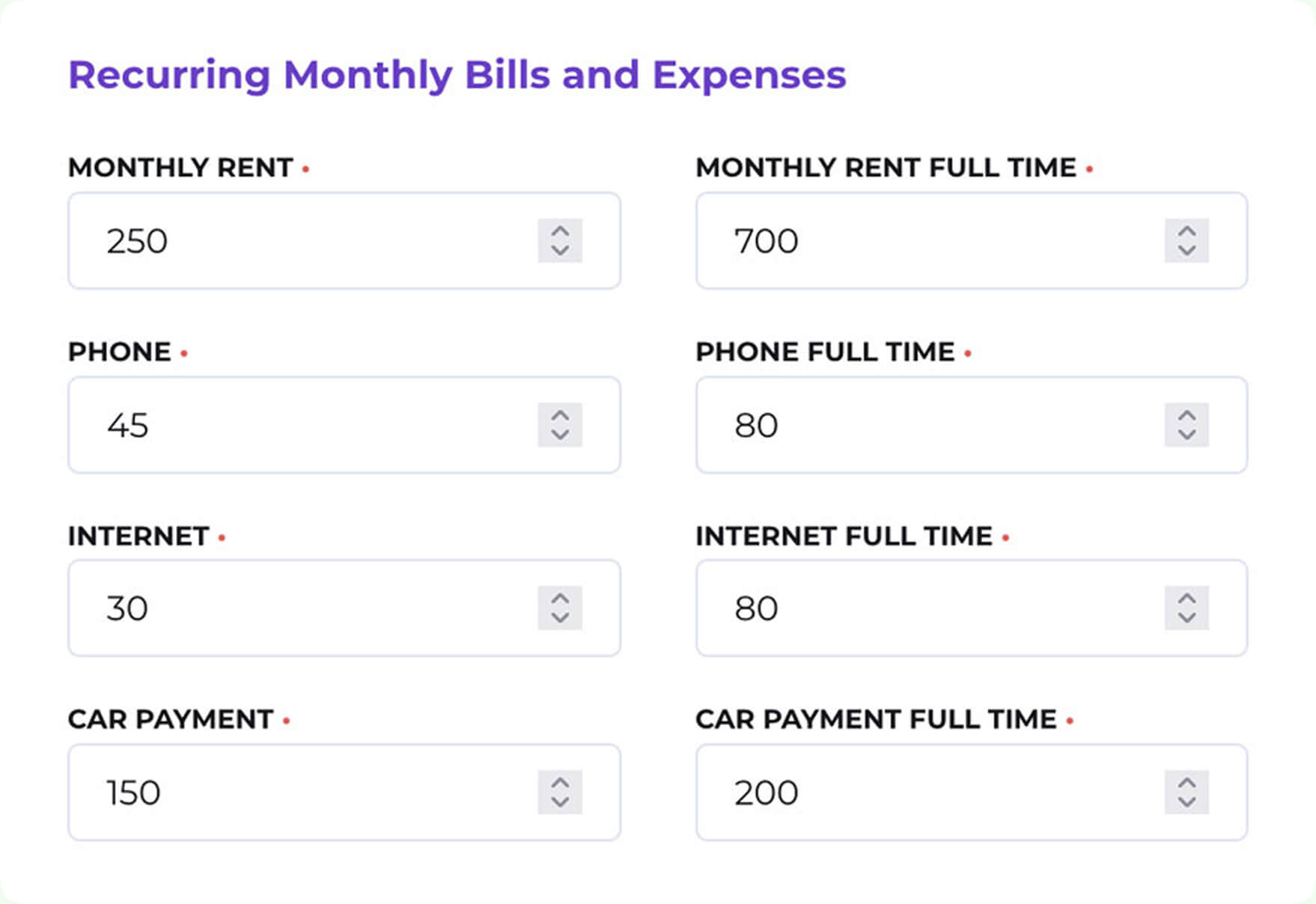

4. StockTrak Personal Budgeting Game

StockTrak’s Personal Budgeting Game works with real-life scenarios you might encounter. You will manage checking, savings, credit cards, emergency funds, and a lot of other things , including unexpected life events.

You can choose one of life-stage scenarios, for example student, a professional, or retiree, and manage your money in a certain role. You’ll be rewarded with badge level progression based on how well you apply financial literacy skills in the game.

5. Build Your Stax

Build Your Stax game for improving financial literacy.

If you wonder how to build your capital in 20 years (or less), year by year, this game is definitely for you. This is a very curious example of a financial literacy game where you have to think using the same concepts.

You get $4,000 every 6 months, and you have to use them through savings accounts, Stock Market Index Funds, Individual Stocks, Government Bonds, etc. Created for adults, but might be interesting for teenagers interested in financials.

How Financial Literacy Games Build Money Management Skills

“Budget wisely”, “save consistently”, “avoid debt traps”, “plan ahead”. All this advice sounds really easy and good on paper. However, understanding a concept and knowing the terms that are circulating in an online space is one thing, while using them properly in your life is completely different.

In this section, we explore how gameplay can impact your financial literacy and help to build the right habits.

1. Building Budgeting Discipline

Schema for visualization of budgeting discipline.

Everyone knows that building the right discipline with money is one of the main things you have to do. And that’s what lies in many, if not most, of the financial games. In other words, you have to budget, and you have to do it wisely. In games, you can see the consequences of the wrong approaches very quickly.

Many finance games for kids show how to prioritize one thing over the other, and, importantly, postpone the immediate satisfaction from purchasing. Years later, they will be using these approaches easily without overthinking.

The thing is, if you manage limited resources for some time, you will develop budgeting reflexes. You will learn to pause before spending, compare options, predict outcomes, and commit to a plan.

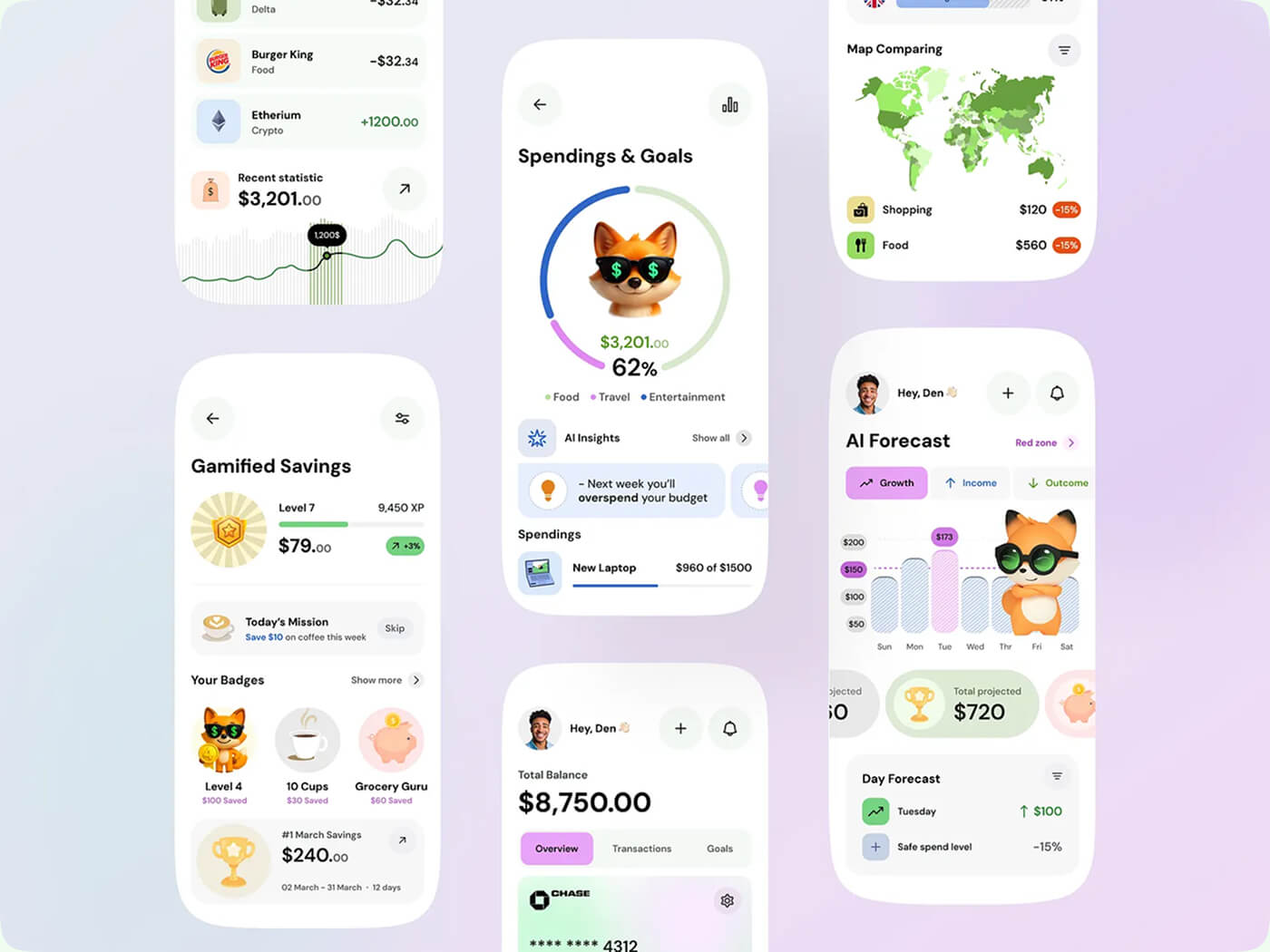

2. Strengthening Saving Habits With Goal-Tracking Systems

Gamified saving goals.

If budgeting is good for knowing what is worth your money and what can wait, saving teaches you how and why to keep the money. The psychology behind the reluctance we feel towards savings is quite easy to explain: the reward from the money we put in a box is delayed.

But if you are playing financial games, delay is experienced and understood, as a result, differently. You will see progress bars fill, streaks build, and milestones achieved. They watch a savings goal inch closer which is an achievement itself. And that’s what can rewire our habits and marketing-based biases towards spending, especially for youth.

If you look at the majority of financial literacy games for kids, you’ll see goal-oriented mechanics. They have to save coins in order to buy an in-game item later, or collect enough points.

Kids quickly learn that saving does not mean denying themselves or saying “no” to what they want. It is actually what allows them to achieve something bigger. Budgeting games for adults, however, have more realistic savings systems:

- building an emergency fund;

- setting aside money for future upgrades;

- saving for investment opportunities;

- resisting impulse purchases.

Even though the design can be different, the psychology is the same. Saving gets easier when the brain can see progress. And this is where games outperform traditional instruction. A simple progress meter or visual savings goal makes behavior continuous in real circumstances.

Pro Tip:

if saving in a game feels fast and easy, it’s lying to the player. Effective saving mechanics should be intentionally slow. They stretch goals over time and make impulse spending painful.

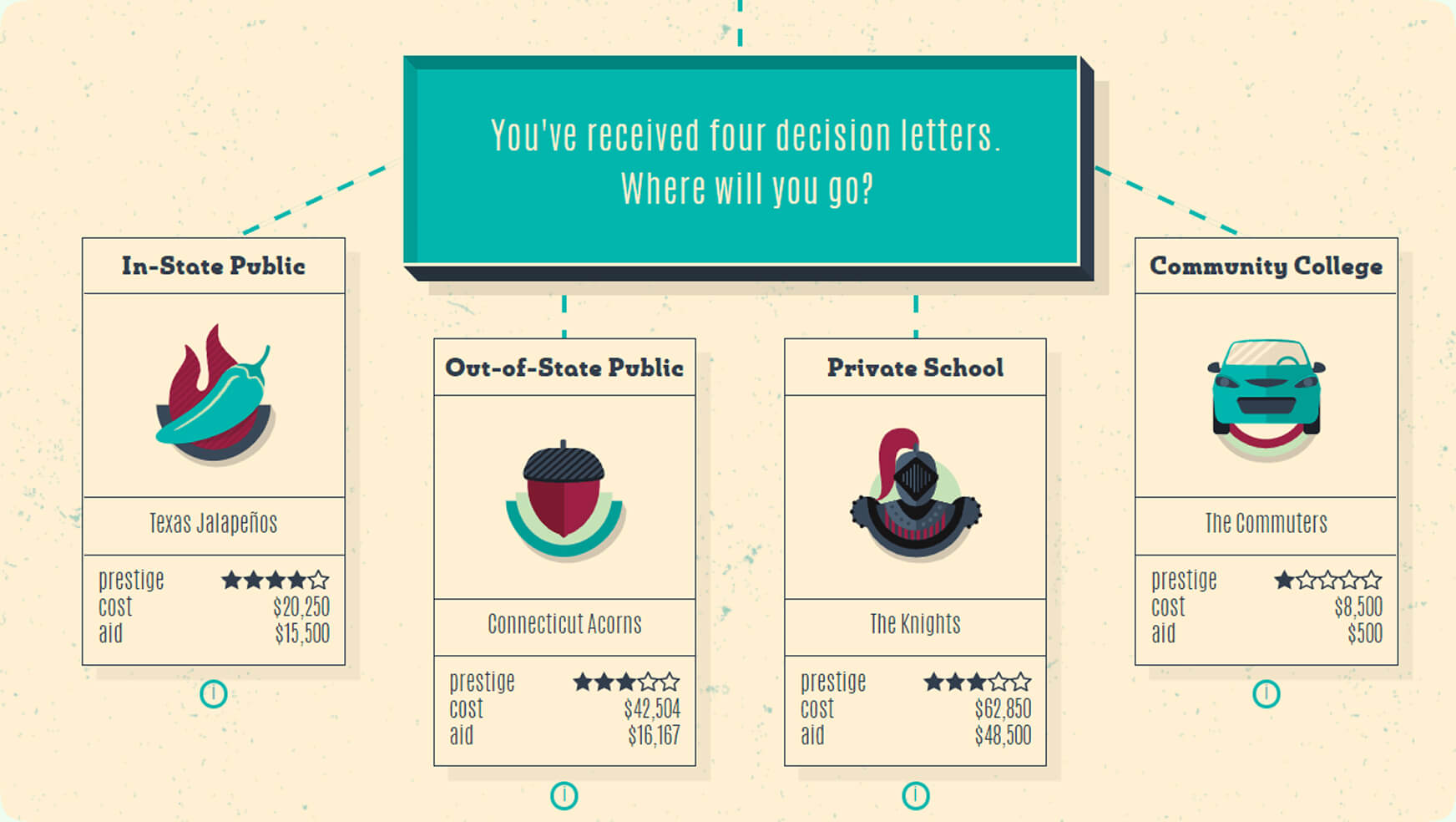

3. Encouraging Smart Decision-Making with Scenario-Based Challenges

Decision-making-based game.

If you want to make smart decisions when it comes to money, all you have to understand is quite simple, a general thing (that still slips from us way too often) – cause and effect. And financial games for adults are using that as a core thing.

If gameplay uses scenarios, what you’ll see right away is the consequences of emotional or habitual spending. You can actually experience the realistic problems that you most likely face in real life.

- Surprise bills

- Sudden price increases

- A break of a tool you needed

- Income drops

- A special offer that might invite you to overspend

- Loans become available with interest

- Savings are needed for emergencies

These scenarios train financial intuition very well. Players learn to pause and ask the same questions they should ask in real life. Games that teach financial literacy should make one reflect: “Do I need this right now?”, “Can I afford it without derailing something else?”, “Is this worth the cost long-term?”, “What happens if I ignore this expense?”

Besides, in financial games with various scenarios for younger audiences, there are also moral or social questions to consider. In the end, these games teach you to see the bigger picture.

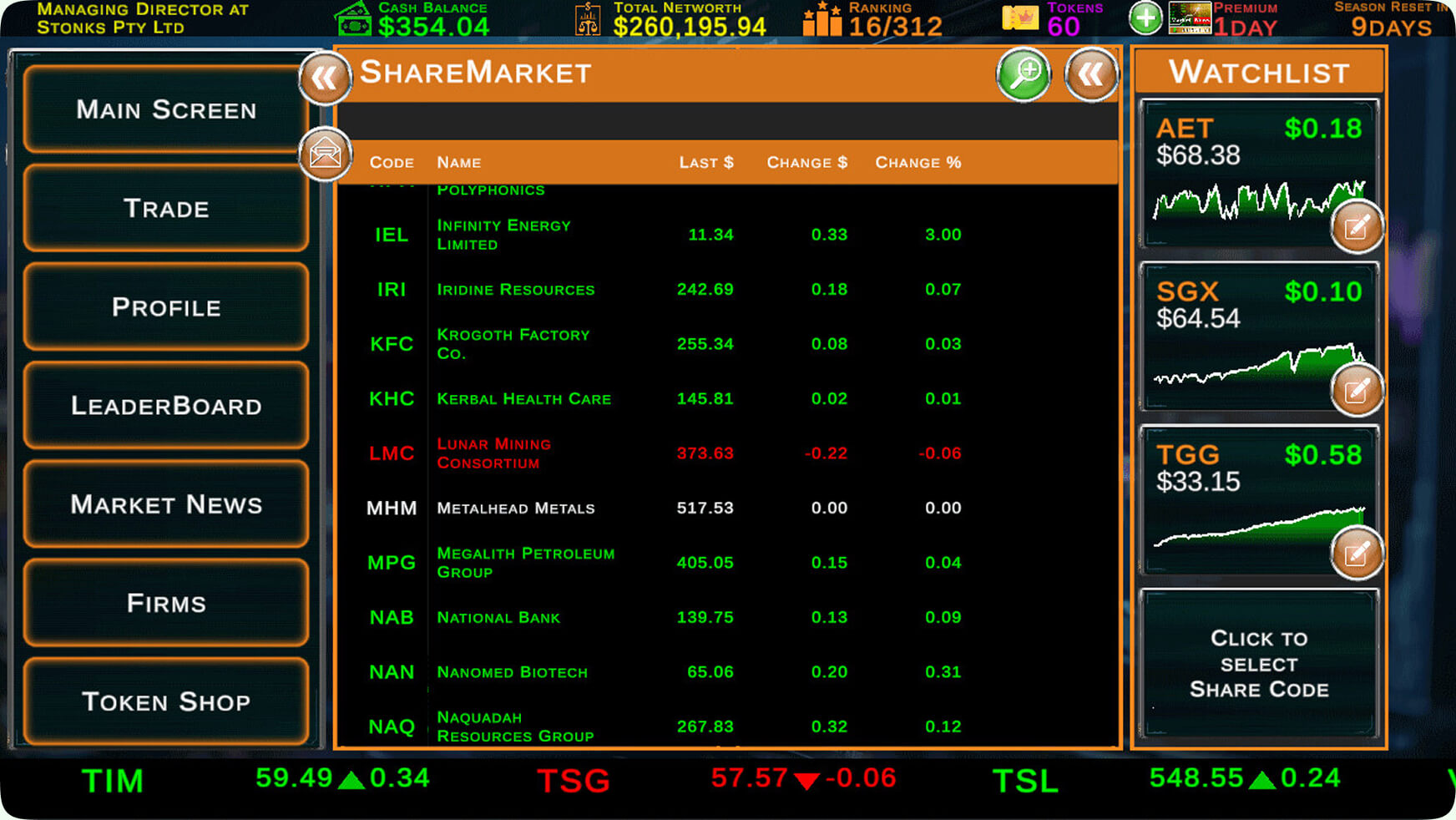

4. Teaching Investment Basics through Simulated Markets

An interface of Stock Market Tycoon: Challenge, a real-time stock market investment game.

Investing quite often seems like an extremely professional area. Even people who know how to budget well and save money, even hesitate when it comes to investing. Why? Because financial markets are too abstract, unpredictable, and… intimidating.

With games, however, you can approach all these things in a different manner. Some financial education games simulate: stock markets, fluctuating asset values, interest accumulation, long-term portfolio growth, diversification strategies, market volatility cycles.

You might think that reading about risk and reward is also helpful. It is, because that’s how you gain knowledge. But if you apply it right away, won’t it affect your budget and investment potential in the best possible way?

Right, it’s much better if you can see your virtual investments rise, fall, and recover, while your actual money remains untouched, before you learn everything. That’s what money managing games let you see.

Another result you get is the understanding of diversification. If you invest everything in one unstable asset, prepare to experience the consequences extremely quickly, usually losing a lot or even everything. Those who diversify can find themselves looking at better long-term results.

But what you need is just simple financial games for kids. They can introduce market basics and make all the concepts accessible. For adults, more advanced simulations are needed to show and experience real-world tools: balancing risk profiles, weighing short-term gains vs. long-term growth, adjusting portfolios, reacting to market events.

As we mentioned before, your main advantage is getting experience without risking a single coin from your pocket.

5. Training Risk Assessment and Long-Term Thinking

Types of risks and rewards related to investing and finances.

Risk assessment is one of the core concepts when it comes to making financial decisions.

Human psychology has built a way that always makes us look for quick rewards. But that means sacrificing something at the cost of something important later. Games can show you how your decision to do something now will affect you later.

It helps players to predict outcomes and evaluate what is not worth the risk. This is the same mental process people use when deciding whether to take on debt, choose a loan, invest, or save. Well-designed games also use:

- time pressure (simulating bill cycles or deadlines)

- consequences that stack (missed payments, rising interest)

- long-term rewards (investments, savings milestones)

- uncertainty (showing real financial unpredictability)

These mechanics help players develop resilience and patience. They learn that not every quick win is worth it, and not every setback is fatal. And that’s, if you think about it, valuable lessons in both money and life.

Did you know?

Research shows that simulation-based financial games can improve analytical, decision-making, and reflective skills by letting players practice choices in realistic, risk-free environments.

How to Choose the Right Financial Literacy Game

Choosing a financial literacy game is… kind of big deal. The right game should match the learner’s age, experience, goals, and, moreover, personality. A well-chosen game can genuinely change financial behavior. A poorly chosen one becomes another abandoned app on someone’s phone.

Here’s how to make a smart choice.

1. Start With the Age Group and Learning Level

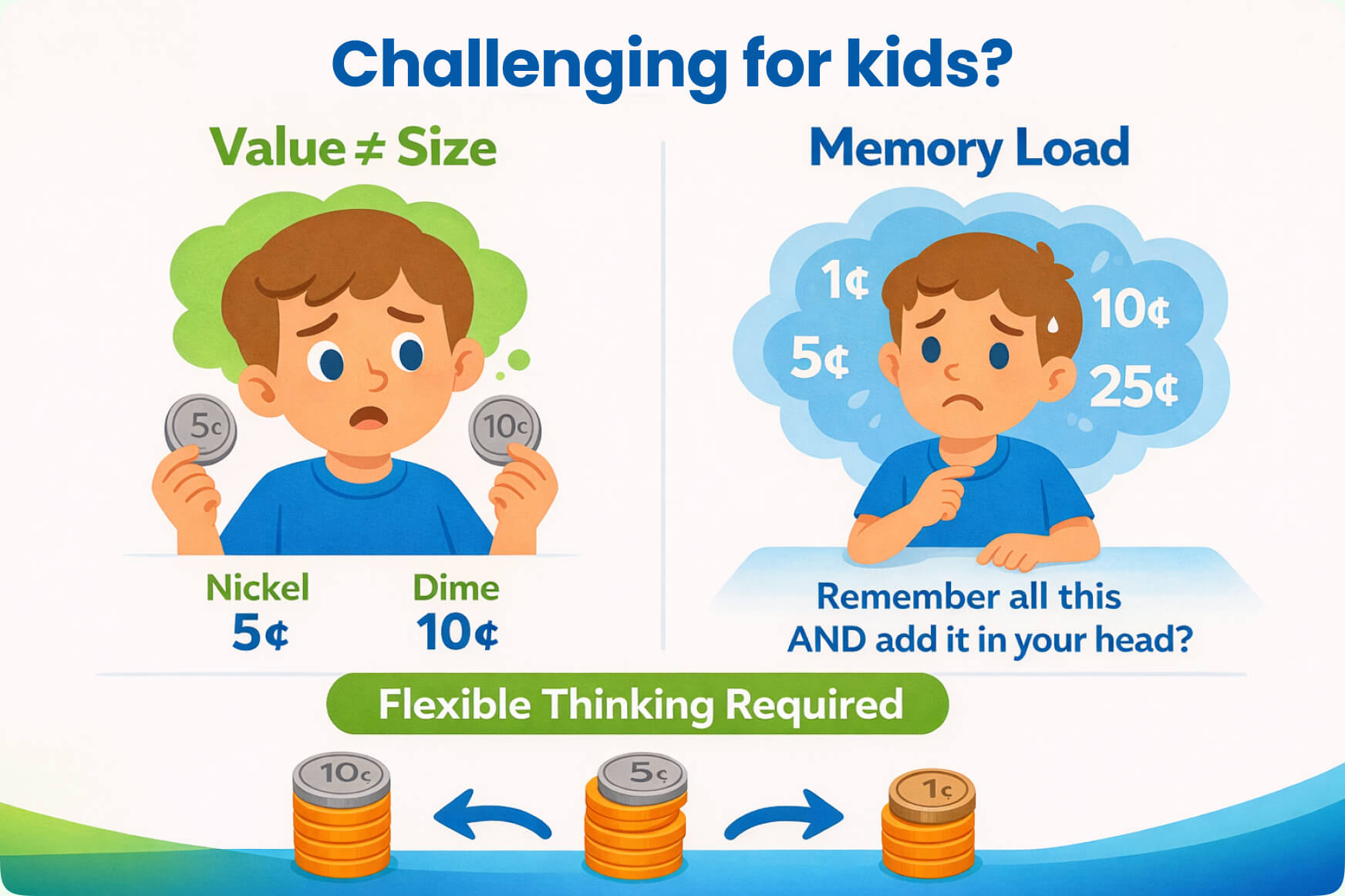

Financial education might seem universal, but now, maybe more than ever, we need to adjust to the attention spans and interests of various age groups. In other words, whatever game you have for a 7-year-old, it won’t ever work for a modern teenager. A stock-market simulator for adults will overwhelm younger people easily.

- Kids: This is the youngest group, and to interest them, you need to add really simple mechanics and an entertaining environment. For example, distinguishing needs vs. wants, earning and spending in small manageable loops, and more things similarly fashion.

- Pre-teens and teens: They already have their own pocket money, so introducing saving challenges and basic investing scenario-based could be fun. Money management games for youth generally are needed more than ever before.

- Adults deserve a full plunge, and, depending on their interests, can choose to learn about market stock, how to invest in crypto, or something plain, like retirement planning and debt management.

An example of a financial literacy game sponsored by Visa.

As you know, every game today is about holding attention. So if the player is young, the loop should be short.

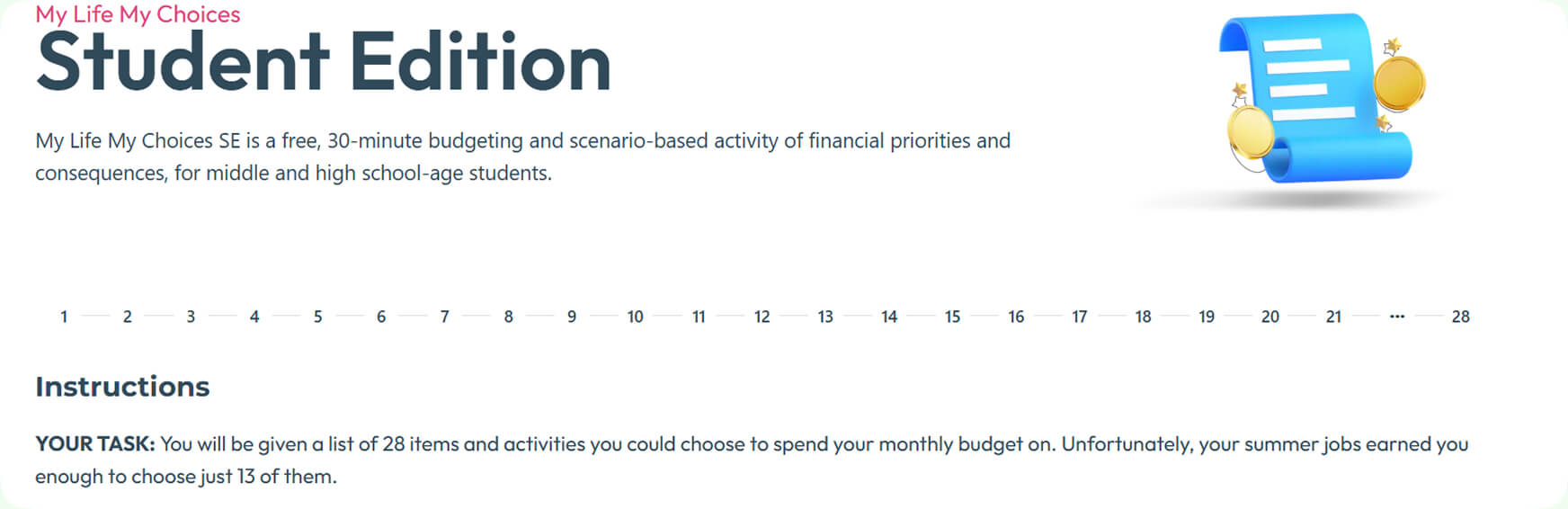

2. Match the game to the skill you want to develop

A budgeting game example.

Financial literacy is a cluster of skills. What does it mean in terms of games and their mechanics? Right, they have to specialize. For example:

- Budgeting games help players to use a limited amount of money in accordance with the situation they have. They are generally good for younger audiences, people who just have to learn how to deal with their money.

- Saving games are supposed to introduce an element of discipline and delayed gratification. Essentially, they are suitable for every age, but the level and complexity should be different depending on the audience. These financial literacy online games are vital as an introduction to the basics.

- Investment simulators are good for adults and adults only.

- Scenario-driven games are useful for anyone who needs practice making smarter decisions under pressure.

So in the end, you just have to choose a game mechanic that makes sense to your current financial literacy goals.

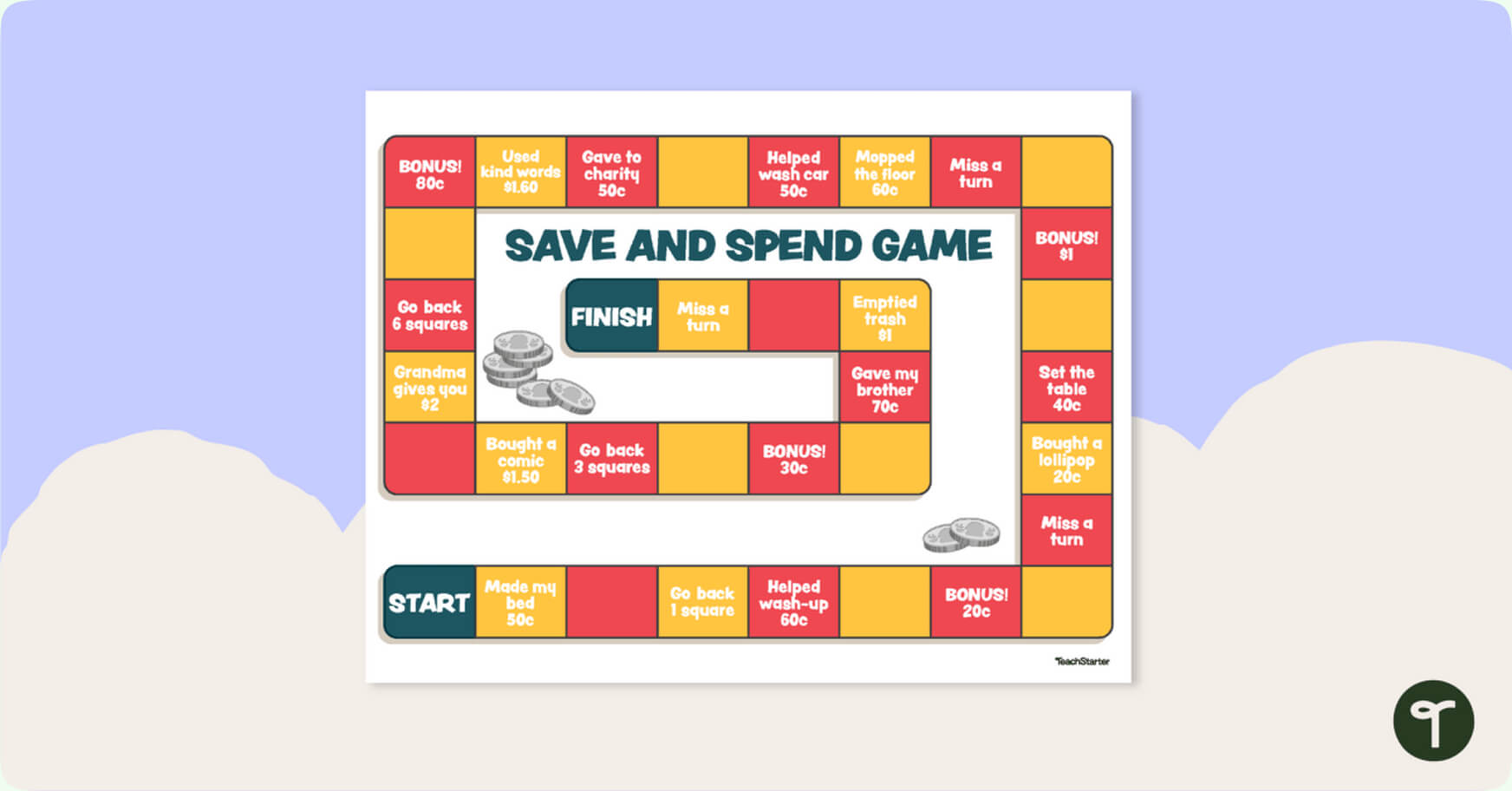

3. Choose the right format: app, browser game, board game, or simulation

A financial literacy board game.

Different formats deliver different learning experiences. Consider how the player prefers to learn.

- Apps work best for daily habits, small interactions, also ongoing reinforcement.

- Browser games are better for classrooms or short bursts of focused learning.

- Board games create face-to-face, family-oriented learning. They work great for group dynamics.

- Full simulations allow deep, immersive learning that mirrors real-world financial behaviors. Money management games for adults, for example, should be like that.

If a player prefers hands-on, tactile learning, a board game might work better. If they want a light but consistent learning loop, apps are the best bet.

4. Match the engagement style and the gameplay mechanics.

One thing you should know is that engagement style can be a dealbreaker. We live in a world and time when personalization matters the most. For one person, quests can be a basic and entertaining way of learning new things, while for the other, something less action-driven is good. Games about money management done in the wrong format might sound to certain audiences as boring as typical, terms-heavy lectures.

Pro Tip:

Consider strategy, instant feedback loops, games, mini-challenges, and streaks as useful formats for financial games.

Conclusion & Recommendations

Financial literacy games are probably the best modern way to explain something so terrifying as financial terms and concepts. Why is it the best? Because it allows you to experience these ideas. Games create a safe environment where mistakes cost you literally nothing, but the experience you gain is real.

Financial literacy games work because they give people useful information without stressing them out. You can always play a game that matches your current knowledge level, and you will always have fun, even if you find some topics not really applicable in your life at the moment.

When money concepts are part of the play, they are no longer some abstract rules we used to hear in schools on boring lectures on YouTube. They actually do real things with consequences.

If you’re choosing a game, you don’t have to overthink it. Try different formats. Some people learn through quick mobile challenges, others through simulations, and board games. For some people or age groups, story-driven experiences work well. What matters most is engagement, because in the end, if the learner wants to come back, the game is doing its job.

And if you’re an organization looking to build your own financial literacy product, we can advise you to follow just one simple rule: learning outcomes depend on how well the experience is designed. Partnering with studios that specialize in educational and kids’ game development, like Fgfactory, helps to create a powerful learning experience that is easy to apply in real life later.

Let’s Build Another Great Game Together with Fgfactory

Fgfactory Australia has spent years developing games. And we never wanted to bring only entertainment, though it is a big part of what we create. But our games teach, guide, and help to build real skills. Financial literacy games, educational apps for kids, money management games for adults, and interactive learning platforms all require a specific combination of design expertise and instructional thinking. That’s exactly where we excel.

We know how to create a budgeting adventure for kids, a financial simulation for teens, or a gamified investing platform for adults. Fgfactory takes your concept and returns to you a polished, engaging product.

We start from the early design phase to UI/UX development, mechanics balancing, prototyping, and go to full production. Moreover, we can guide the entire process.

If you’re considering a new financial literacy game or want to bring interactive learning to your organization, let’s talk. We’d love to help you build something meaningful, useful, and genuinely enjoyable.

Ready to create an educational game that makes an impact?

SUMMARIZE THIS PAGE

Contact us